Three noted compliance experts -- Joann Needleman, partner and leader at Clark Hill, Brit Suttell, a Barron & Newburger shareholder, and John H. Bedard, owner of Bedard Law Group – recently participated in a webinar hosted on AccountRecovery.net. It didn’t take long for the discussion to turn to personalizing agent coaching as one of the best ways to increase both compliance and performance.

The panelists all agreed that training is probably the most crucial element of an agency’s Compliance Management System (CMS). It is also one that has a significant impact on agency success, since the CFPB and courts often examine training activities to check whether agencies are meeting their remediation obligations. “Failure to train” is one of the main reasons for enforcement actions.

In contrast to the one-time, well-defined tasks of setting up the “P’s” – policies and procedures – ensuring that all staff is well-versed in them is an open-ended process. All three panelists touched on the difficulty involved in determining if an agent needs to be retrained on specific points. The fluidity of the regulatory space presents a more general challenge: Training must be conducted consistently, per regulations, despite the fact that those regulations often don’t detail the scope of training. As a result, agencies may be unclear about who to train, when, what to include and how to cope with frequent changes in regulations.

{{qoute-9}}

To minimize risk in this ambiguous situation, our panelists recommended adopting a personalized training approach, which John characterized as “surgical, data-driven”. Their vision is of training as an integral, ongoing element of agency operations which empowers agents to maintain compliance and minimize risk. To realize this vision, training must be:

Role-specific

Training all staff on all topics is a waste of time – and time is money. Frontline collectors, for instance, must be familiar with the many rules about verbal communications and able to apply them correctly in real time, during calls. Administrative staff that post payment letters, however, only need to understand the obligations relating to that specific part of the recovery process. Smart agencies don't waste their agents’ time by providing blanket training, but rather produce role-specific content so they can deliver information about specific topics only to people for whom it is relevant.

Need-specific

It is similarly wasteful to pull proficient, well-performing agents off the floor to attend generic FDCPA review sessions. Instead, tailor training to each individual agent’s needs. As Joann and John pointed out, technology is available that can measure each agents’ performance and pinpoint deficiencies. Based on this data, personalized coaching can be used to improve individuals’ outcomes. While training should focus primarily on role- and need-specific content, our panelists recommend periodic collective sessions to update staff about broadly applicable regulatory changes and convey important company information.

Timely

By the time a violation is surfaced during a weekly or monthly audit, the responsible agent rarely remembers the incident. After all, they have probably handled hundreds of calls since -- and chances are, repeated the same error on many of them. To both increase awareness and quickly extinguish non-compliant behaviors, shortening “time-to-training” is essential for frontline collectors. Real-time data monitoring and automating the assignment of relevant training units are the keys to more timely and effective training.

Easily absorbed

Traditionally, compliance training meant having agents read tedious, dull written guides. It’s likely that at least some members of your staff won’t be able to handle the material or retain it well. For many, this type of training is a stressful, overwhelming and demotivating experience that has the opposite effect of what was intended. With Gen Z now joining the workforce, your staff is likely to include individuals with vastly different learning styles and media consumption habits. In the case of training, Gen Z has it right: Video is a highly effective learning tool since consuming material through visual and audio has been shown to tangibly increase retention rates. During the webinar, Brit highlighted that there are many easy-to-use tools that can convert existing training content into video format, with no need for professional editing, actors or voice-over artists.

Bite-sized

For training, the panelists liked the idea of riding the TikTok wave and serving content in small, easy-to-absorb video nuggets. These micro-learning units can be presented to collectors in a continuous trickle, with each agent receiving content that addresses their own personal challenges as uncovered by monitoring. Agents can consume these video bites at their own convenience, ideally at the times that they are most able to absorb learning content. To assess whether the training is effective, a couple of quiz questions can be added at the end of the video. Alternatively – or in addition – agents can be offered an opportunity to give feedback on whether the content was clear or if there are points they’d like to clarify in a personal meeting with their manager.

{{qoute-8}}

Think building out this type of training system is too overwhelming for your agency? Think again.

It’s fair to assume that this kind of approach takes a great deal of investment of human and financial resources. Fair – but according to our panelists, incorrect: From their experience, integrating some of the elements mentioned above into your CMS doesn’t need to be complicated or expensive. What’s required to make personalizing training simple, they all agreed, is technology. And if that sounds expensive, Joann disagrees: “Data-driven compliance and training technology is already out there and not that costly. Your investment will be quickly offset by reducing the compliance workload, as well as the number of additional trainers you’d need to bring on to handle it all.”

Investing in training and introducing smarter, data-driven systems also decreases risk and legal costs and - equally important - increases workplace satisfaction and employee retention. John pointed out that there is a significant gain in efficiency even if the only change is having agents sit through just the training they really need, since as a result, the most skilled and compliant collectors won’t be pulled off the floor.

Tech-based learning processes come with another important benefit: All your efforts are documented. As one of the panelists said: “Training that isn’t documented hasn’t happened, in the eye of the auditor or investigator.”

{{qoute-10}}

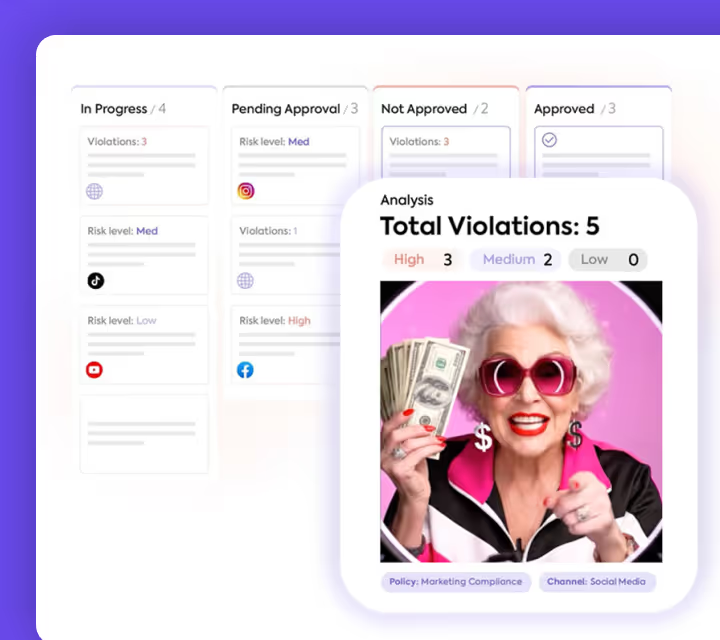

Sedric - tick(tok)ing more than one of the boxes above

At Sedric, we have integrated many of the above considerations into our platform, to help agencies transition to data-driven compliance management. Sedric leverages real-time data monitoring to understand collectors’ deficiencies and propagate bite-sized videos to them. Training and compliance leaders can easily follow up on training completion. Sedric comes with a ready library of videos explaining FDCPA, FTCA and UDAAP requirements. Trainers and compliance leaders can easily build additional videos using the AI avatar that automatically transforms textual training content into TikTok style videos. With all mitigation and training efforts automatically documented, agencies account for all the data and reports creditors, auditors or investigators might require.