Take the headache out of lending compliance

Sedric’s compliance excellence platform detects compliance risk across all consumer interaction channels in real-time, so lenders can quickly remediate to protect their brand and improve their service.

100%

audited interactions

Let AI analyze every customer interaction for a complete view of risk, rather than relying on random sampling.

98%

accurate risk identification

Our AI detects non-compliant practices with unparalleled accuracy, and without producing a flood of irrelevant alerts.

Up to 50% increase in productivity

Review only flagged events instead of entire conversations and let AI fill in scorecards.

Let Sedric cover your lending compliance

In today’s highly regulated environment, lending compliance and consumer protection are an absolute must for fintechs.

Sedric’s AI-based automated platform provides real-time intelligence to immediately identify and remediate violations or misleading practices across all communication channels. Sedric is the first solution in the market that analyzes interactions as part of particular phases in the lending process and generates accurate alerts in case of omissions and other compliance breaches.

Based on insights on team members’ performance, Sedric tailors individual training paths to drive continuous improvement. With all records archived and remediation actions fully documented, Sedric clients are audit-ready at any time.

Extract & archive

Extract & archive

Sedric records and archives client interactions in any format, stores them in a central place and lets you easily document your processes for audits.

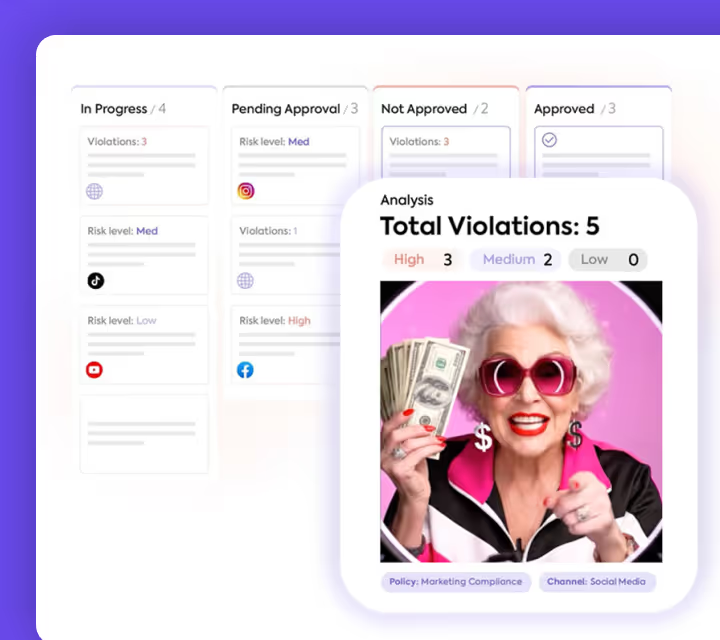

Detect & score

Sedric flags violations in each conversation and analyzes the interaction journey as a whole to detect omitted disclosures and steps, without producing a flood of irrelevant alerts. Automated scoring saves valuable agent time

Manage workflow

Sedric automatically generates tasks to mitigate risks and improve agent performance. Manage all tasks in a single place and make sure nothing falls between the cracks!

Analyze & train

The Sedric dashboards provide you with a 360° perspective of your risk and performance, letting you drill down to individual events as well as discover high-level trends to train your team and optimize your operations.

Book a free 30 min demo

to discover how Sedric can reduce your regulatory burden and free your lending business to focus on growth!

to Comply AND Excel

Single pane of glass

Monitor risk and performance across your full operation via one central interface

Omni-channel

Monitor and analyze customer journeys across voice, chat, email, video, and social media interactions

Automated detection and scoring

Save your QA staff valuable time and increase your overall productivity

Multi-level dashboards

Provide agents and quality control, compliance, and management teams with the insights they need

Data privacy and security

Protect sensitive data with automated PII redaction and encryption

Workflow management

Manage all activity from alert to remediation and training in a single pane

Seamless integration

Quickly and easily integrate Sedric with all your communications systems

Customized video training

Improve performance through individualized video training based on each agent’s needs

Audit-readiness

Document your compliance processes and activities accurately and effortlessly

Single pane of glass

Monitor risk and performance across your full operation via one central interface

Omni-channel

Monitor and analyze customer journeys across voice, chat, email, video, and social media interactions

Workflow management

Manage all activity from alert to remediation and training in a single pane

Multi-level dashboards

Provide agents and quality control, compliance, and management teams with the insights they need

Data privacy and security

Protect sensitive data with automated PII redaction and encryption

Seamless integration

Quickly and easily integrate Sedric with all your communications systems

AI-powered

Detection and prediction abilities are continuously sharpened and refined as your operations expand

Customized video training

Improve performance through individualized video training based on each agent’s needs

Audit-readiness

Document your compliance processes and activities accurately and effortlessly

Collecting debt?

Check out our solutions for creditors and debt collectors subject to FDCPA, UDAAP, and additional regulations.

.png)