New York, NY – December 11, 2025 –Sedric, the AI-powered compliance platform for regulated financial services firms, today announced its inclusion in the 2026 RegTech100. The recognition reflects accelerating adoption of Sedric’s AI agents, which now support compliance, marketing, and customer-facing teams by removing the operational friction traditionally created by manual review processes.

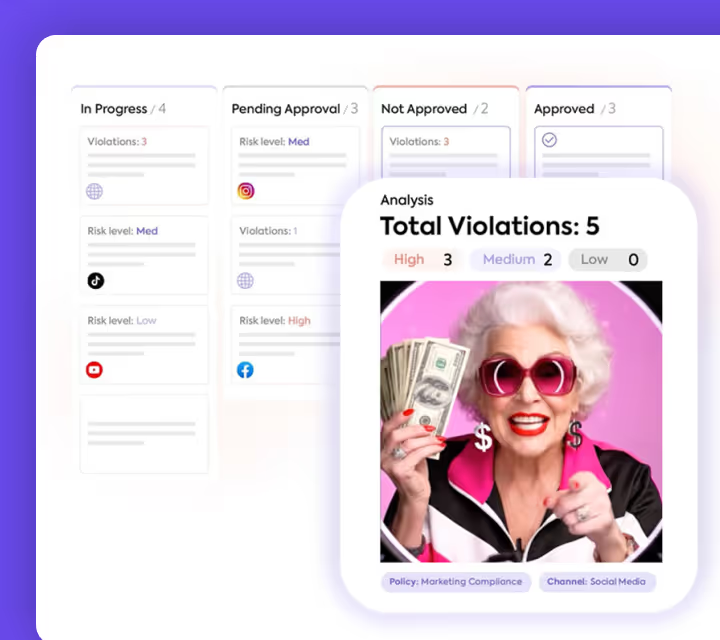

As communication and content volumes continue to grow, institutions are restructuring how compliance is executed. Sedric’s dedicated-model architecture deploys AI agents that operate continuously across customer interactions and marketing workflows—identifying risks, recommending corrective actions, and enabling business units to move faster with confidence. This shift has transformed compliance from a bottleneck into an embedded operational capability.

Sedric’s 2025 platform analysis shows that organizations adopting Sedric expanded compliance oversight from manual sampling of less than 5% of communications to continuous review across all channels. The platform also identified that a significant share of compliance issues occurred in materials already approved by human review, underscoring the limitations of legacy workflows. Sedric’s AI agents close this gap by providing real-time and pre-distribution guidance, as well as continuous post-distribution monitoring.

“Recognition in the RegTech 100 underscores the fundamental shift underway,” said Nir Laznik, Sedric Co-founder & CEO. “Institutions want to grow without slowing down for compliance. Since the advent of GenAI, the volume and velocity of communications and marketing content have increased exponentially—stretching traditional compliance processes beyond their limits. Sedric’s AI agents give firms the oversight they need at the speed their business operates, enabling faster execution, fewer errors, and reliable governance across communications and marketing.”

Sedric provides a unified control layer for financial institutions, spanning real-time agent assist, automated pre-approval review, and continuous monitoring across internal and partner ecosystems. Each deployment includes a dedicated compliance model engineered around the institution’s regulatory requirements, product constraints, and operational workflows. This approach delivers higher detection precision, fewer false positives, and full interpretability at enterprise scale.

Sedric is rapidly expanding across banking, credit cards, fintech, lending, and collections, and is increasingly used as foundational infrastructure for organizations modernizing their compliance and operational frameworks.