Running a Race that No One Can Win

Worldwide, financial firms are stuck in a compliance conundrum: Despite dedicating unprecedented sums to being compliant, they are failing to keep up with the lightning pace of regulatory changes.

Let’s start with some numbers: Today, per-employee compliance costs, on average, about $10,000 for financial services firms, representing 6%-10% of total revenues. Worldwide, $181 billion per year is spent on maintaining compliance with regulations designed to prevent financial crime.

Stunning as those figures are, they represent the least costly scenario. The 2008 financial crisis spurred governments worldwide to examine their financial sectors to identify vulnerabilities that might lead to similar events. The result, which the industry is still feeling today, was an unprecedented acceleration in the pace at which regulations are issued: Today, regulations are changed at 5 times the rate as they were before 2008. For example, in 2019 and 2020 alone, the SEC published 147 changes in rules and issued 263 guidance notes. And of course, the SEC is just one of several agencies that regulate the US financial services industry.

The pace of regulatory change has gotten so fast – and regulations have grown so complex -- that financial firms simply don’t have enough time to understand what has changed and what they are required to do, in time to do it. To meet regulatory deadlines, many risk and compliance teams operate on the basis of partial information, acting on best guesses and stopgap measures. The result is regulatory environments that are fragmented and incomplete, and leave organizations insufficiently compliant, at best

…And Losers Lose Big

At an average of $2 million per year per enforcement action (in addition to already-staggering compliance costs), fines for non-compliance are no trivial matter – unless you compare them to the true full costs to firms as a result of being found non-compliant. These costs include business disruption due to the enforcement action, typically estimated at $5 million; revenue loss of $4 million; and $3.7 million due to lost productivity.

These figures -- totaling almost $15 million per year per enforcement action – still do not represent the entire story. Negative press about enforcement actions results in huge drops in stock prices. Studies have found that the stock market hit is typically 9 times as large as the fines which are imposed. And even these costs pale in comparison to licensing impact that may follow enforcement actions. But we’ll save that issue for another post.

Staying Ahead as Targets Move

These dismaying figures convey a clear message: Staying compliant is a smarter, more sensible path. The incentives line up: Compliance costs are roughly 63% lower than the costs of penalties and business disruption – without even considering hits to stock valuation.

For most firms, therefore, the big question is not whether to be compliant, but how to keep up with the superhuman pace at which new regulations are issued or updated, or even clarified and made more precise. As in so many areas, where change has exceeded our ability to keep pace, technology can step in to help, in the form of automated, AI-driven compliance solutions.

Reduce Regulatory Ambiguity and Compliance Lag

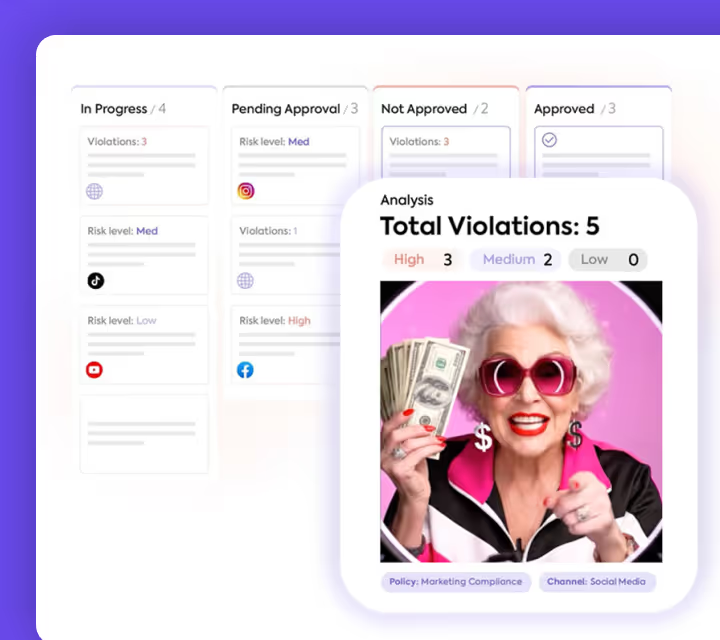

Automated compliance systems can streamline tedious manual processes, reduce errors, and free compliance teams for higher-level tasks. Add Artificial Intelligence, natural language programming (NLP), and multi-language capabilities and suddenly, your system can monitor all conversations, identify breaches in near-real-time, quickly route issues to agents for remediation, and then check to ensure that proper actions have been taken.

Sedric continually monitors regulatory applications of top law firms, worldwide, and integrates their guidance in its regulatory engine. Customers can be assured that Sedric can apply the most up-to-date and complete regulatory information available – subject to client agreement, of course – and can help them quickly implement needed changes.

For clients that opt for different interpretations, Sedric automation enables rapid updates to customized rule sets. Sedric relieves organizations of the relentless pressure to keep up with reading and analyzing frequent regulation updates; determining their practical ramifications; and updating compliance programs and enforcement procedures. Instead, they can depend on Sedric to rapidly integrate updates in its regulatory engine and to automatically enforce changes without their effort or involvement.

Discover how the Sedric AI-driven, automated compliance platform can reduce the cost and complexity of staying compliant.