Introduction

In the demanding ecosystem of debt recovery, success hinges not only on how many calls your agents make—but on how well those conversations are understood, analyzed, and acted upon. That’s where speech analytics comes in.

Once considered a “nice-to-have,” speech analytics has now become a mission-critical tool for debt collection agencies striving to improve recovery performance, reduce compliance risk, and elevate the consumer experience. In this article, we explore how speech analytics works, the challenges and opportunities it presents for collections firms, and how AI-powered solutions like Sedric are transforming how agencies harness voice data.

What Is Speech Analytics?

Speech analytics refers to the process of capturing, transcribing, and analyzing voice conversations to uncover insights, trends, and actionable intelligence. In debt collection, this technology is used to:

- Monitor agent performance

- Detect compliance violations

- Understand consumer sentiment

- Identify frequently used objections or phrases

- Spot patterns in payment behavior or disputes

Advanced platforms use AI and machine learning to analyze 100% of recorded calls, providing both real-time and post-call intelligence.

Challenges in Traditional Debt Collection Call Monitoring

1. Limited Call Sampling

Most agencies still rely on manual quality assurance (QA), which reviews just 1-2% of all interactions. This creates blind spots and exposes firms to compliance and performance issues.

2. Inconsistent Scoring and Feedback

Manual QA can be subjective and vary by reviewer. Inconsistencies in scoring lead to inconsistent coaching and missed opportunities to improve.

3. Delayed Insight Delivery

Waiting days or weeks to receive feedback on a call limits the ability to course-correct or intervene before an issue escalates.

4. Compliance Risk Exposure

Missed disclosures or aggressive language can trigger regulatory penalties. Without comprehensive call monitoring, firms may be unaware of these risks until it’s too late.

The Opportunities: Why Speech Analytics Is a Game-Changer

1. 100% Interaction Coverage

AI-powered speech analytics can evaluate every call, providing a complete picture of what’s happening across your portfolios. No more sampling—every conversation is analyzed.

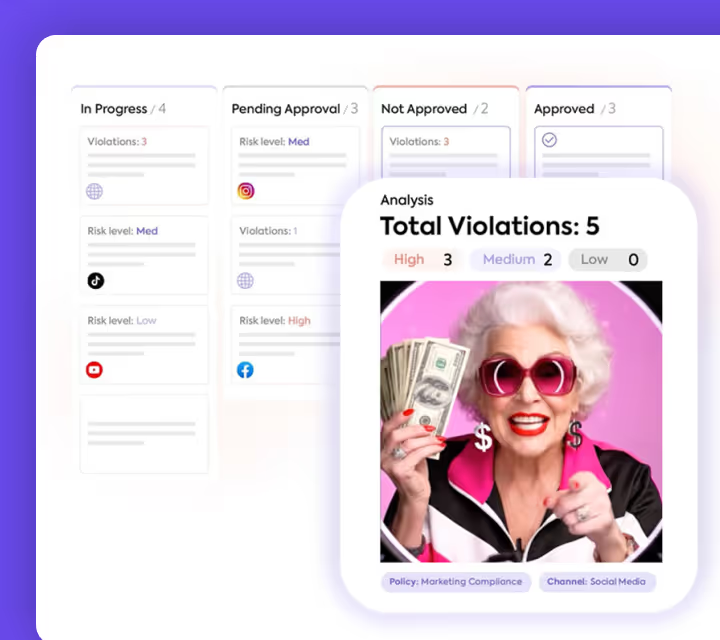

2. Real-Time Compliance Monitoring

Modern tools identify non-compliant language or script deviations as they happen. This allows for instant corrective action and proactive risk mitigation.

3. Data-Driven Agent Coaching

Instead of general feedback, managers can deliver targeted coaching based on actual call patterns. This improves training effectiveness and agent performance.

4. Consumer Insights and Segmentation

Speech analytics reveals how consumers respond to various strategies, which objections are most common, and how sentiment shifts throughout a call. This enables more personalized and effective outreach.

5. Improved Recovery and Efficiency

By identifying the language and tactics that lead to successful outcomes, agencies can replicate high-performing behaviors and refine scripts to drive more resolutions.

How Sedric Uses Speech Analytics to Power Debt Collection Success

Sedric is an AI-powered compliance and performance management platform designed specifically for debt recovery and financial services. It goes beyond transcription and keyword spotting to deliver real-time and post-call insights that elevate every aspect of your collections operation.

Key Features:

1. Real-Time Speech Analytics

Sedric listens to live calls, identifies potential compliance issues or missed disclosures, and prompts agents in real time to course-correct.

2. Automated QA and Scoring

The platform scores 100% of calls automatically, ensuring consistent evaluations and surfacing the most impactful conversations for review.

3. Call Summarization and Tagging

AI-generated summaries and outcome tags reduce after-call work and enhance data consistency across teams.

4. Performance Dashboards

Managers get a full view of agent behavior, call quality, and risk signals, helping them coach more effectively and allocate resources wisely.

5. Compliance Heatmaps

Sedric visualizes trends in risk exposure across teams, helping agencies identify and address systemic issues before they escalate.

Business Impact of Speech Analytics in Debt Recovery

- Increased Liquidation Rates: Identify and replicate successful call tactics that drive payments.

- Reduced Regulatory Risk: Spot and resolve non-compliance before it leads to fines.

- Faster Agent Ramp-Up: New agents receive focused feedback based on real performance data.

- Better Client Reporting: Share QA coverage, risk management stats, and call outcomes with clients to boost trust and retention.

- Improved Consumer Experience: Tailor conversations based on sentiment and behavioral insights, improving resolution rates and satisfaction.

Conclusion

Speech analytics is no longer optional for debt recovery—it’s essential. In an environment where performance and compliance must go hand-in-hand, AI-powered tools give agencies the clarity and control they need to operate more efficiently and recover more debt.

Sedric empowers collections teams with the ability to monitor every call, guide agents in real time, and deliver data-driven insights that fuel better outcomes.

Book a demo to see how Sedric’s speech analytics capabilities can transform your debt recovery strategy.